JOB WORK UNDER GST.

Dear all,

Your association Silvassa Industries & Manufacturers Association would like to forward herewith the Provision of “Job Work“ as define and clarified in Model GST Law for your information. You are requested to go through the provision in detail and also watch the video for better understanding of the provision and according plan to assign job work. Your Association request you to follow the procedure & provisions prescribe under the topic “Job Work” and remove the goods for certain purposes on payment or without payment of tax as case may be.

Job work has been defined under Section 2(62) of the Model GST Law as undertaking any treatment or process by a person on goods belonging to another registered taxable person and the expression “job worker” shall be construed accordingly.

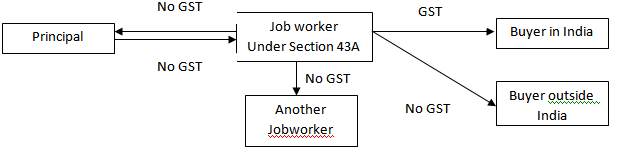

For all purpose of GST Law, Job worker, except the Job worker specified in Section 43A shall be construed as a separate taxable person and thus, all supply of goods and / or services between the Principal and the Job worker shall be subjected to GST. Thus, it shall not be limited to levy of services or supply of goods during job work to Principal.

Section 43A (1) of the Goods and Service Tax Act, 2016 is applicable to both the Acts i.e. the CGST Act as well as the SGST Act. The section provides that the Commissioner may permit a registered taxable person (herein referred to in this section as the “principal”), by special order and subject to conditions as may be specified by him, to send taxable goods, without payment of tax, to a job worker for job-work and from there subsequently send to another job worker and likewise.

After completion of job-work, allow to-

- bring back such goods to any of his place of business, without payment of tax, for supply therefrom on payment of tax within India, or with or without payment of tax for export, as the case may be, or

- supply such goods from the place of business of a job-worker on payment of tax within India, or with or without payment of tax for export, as the case may be.

Please go through the attached video for more details:

This is for your information.

Thanking you,

With regards,

For Silvassa Industries & Manufacturers Association,

Narendra Trivedi,

Secretary